For most of the population, the concept of venture capital funds is not clear. However, these funds are very important. With the right approach, these funds can elevate a business to a level where it generates millions in profits. These funds invest in startups. How exactly? This article covers it from start to finish.

What is Venture Capital Fund?

VC funds are funds that invest in startups. They identify promising startups in the early stages of development, evaluate the idea, and decide whether to invest. They make investments in exchange for a stake in the startup or a portion of its shares, if available. When a startup reaches its peak potential, venture capital funds sell shares or stakes. This is their reward for the investment. In addition to equity in the startup, they may negotiate for a seat on the board of directors or financial perks such as dividends.

What is the Importance of Venture Capital Funds?

Venture funds are considered alternative investments. They are important not only for startups but also globally significant for scientific and technological progress, the economy of specific sectors, countries, and the world economy as a whole. When someone comes up with something significant, often there isn’t enough funding available. As a result, the invention gets forgotten. Venture funds finance inventions, thus helping inventors realize their ideas.

How to Get VC Funding?

To obtain venture funding, you need to do the following:

- You need to create a business plan and submit it to a venture capital firm or angel investor. After that, the business plan will be thoroughly reviewed and evaluated.

- In the second stage, the investor and the startup sign a contract, whereby the investor commits to inject capital into the startup and receive a share in the company. Rarely do funds get invested all at once; more commonly, they come in stages. Additionally, the investing firm participates in the company, providing valuable advice and exercising control.

- The investor exits the company, usually after several years, by selling their stake or shares.

What are the Methods of Financing by Venture Capital Funds?

Venture funds may invest the entire sum at once, but this is very rare. More often, investments occur in stages. For example, initial investment — when production needs to be launched and the entire process needs to be set up, funding for expansion, late-stage funding — when there is significant turnover but no profit, funding for initial public offering. These stages can be divided and even named differently, but the essence remains the same.

What is the Structure of a VC?

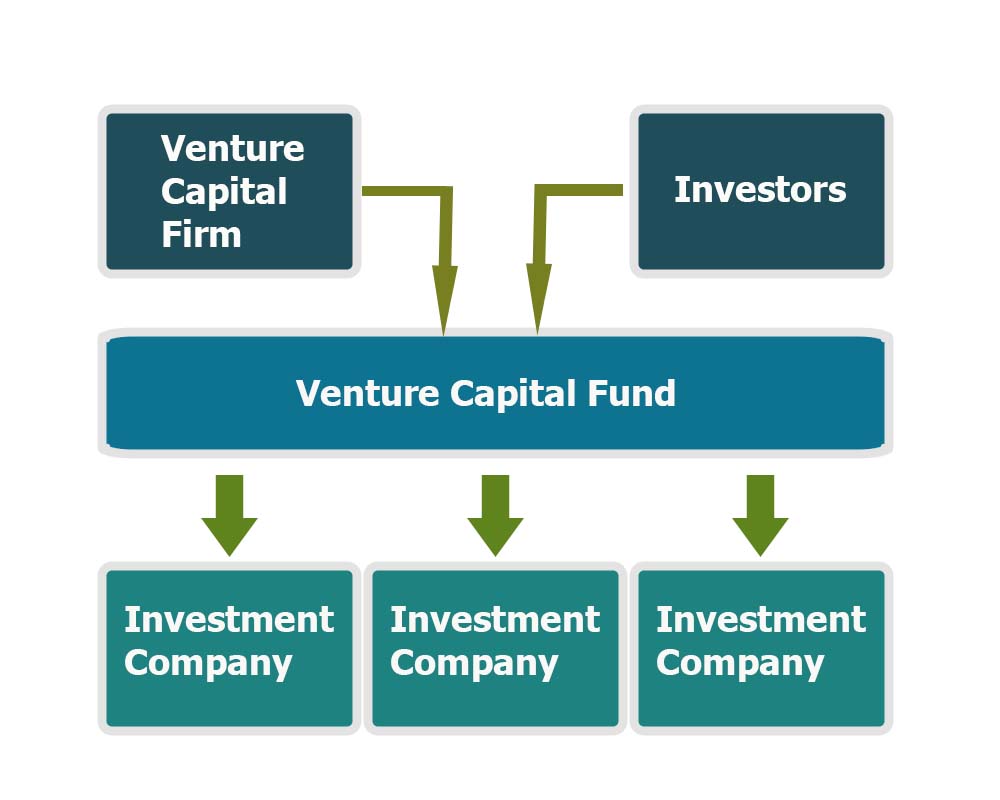

Venture companies, together with investors, establish a venture fund. Then, venture companies review startup proposals, and if the decision is positive, they provide financing to them. The structure is schematically depicted in the image.

What are the Risks and Disadvantages of Venture Capital funds?

Returns from venture investments are typically highly lucrative. However, they are also risky. The most probable risk is that the startup in which they invested will not succeed. Then, everyone will lose their money. There are countless reasons for this.

Some disadvantages include:

- By receiving investments from venture funds, a startup loses full control over its operations, as the funds become partial owners.

- This is a long and challenging process.

- This process and its benefits should be considered only from the long-term perspective.

Conclusion

Venture capital funds play an extremely important role in the financial and investment sector. They help to uncover and implement the ideas of developers and inventors. Without them, these ideas would remain just ideas. Assistance in the development of startups is support for the country’s economy, new jobs, and the promotion of prosperity.

Pingback: Alternative Investment Funds (AIFs) - Stock 'n Investments