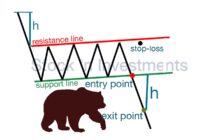

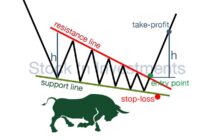

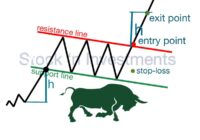

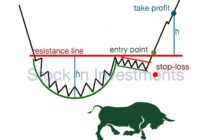

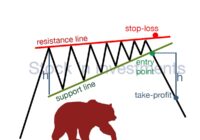

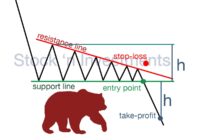

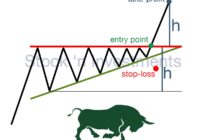

Inverse Cup and Handle: Entry & Exit Point, Stop-Loss, Volume

The inverse cup and handle pattern is a bearish reversal pattern, indicating a potential decline in price following a brief consolidation period. It is called an inverted cup and handle or upside-down cup and handle, and it is one of the stock market patterns. Steps for trading the inverse cup and handle pattern Identify the… Read More »