Wedge patterns are a key concept of stock market patterns, offering traders insights into potential price movements. Understanding and trading these patterns effectively can significantly enhance your trading position in wedge pattern trading. Let’s consider two types of wedge patterns.

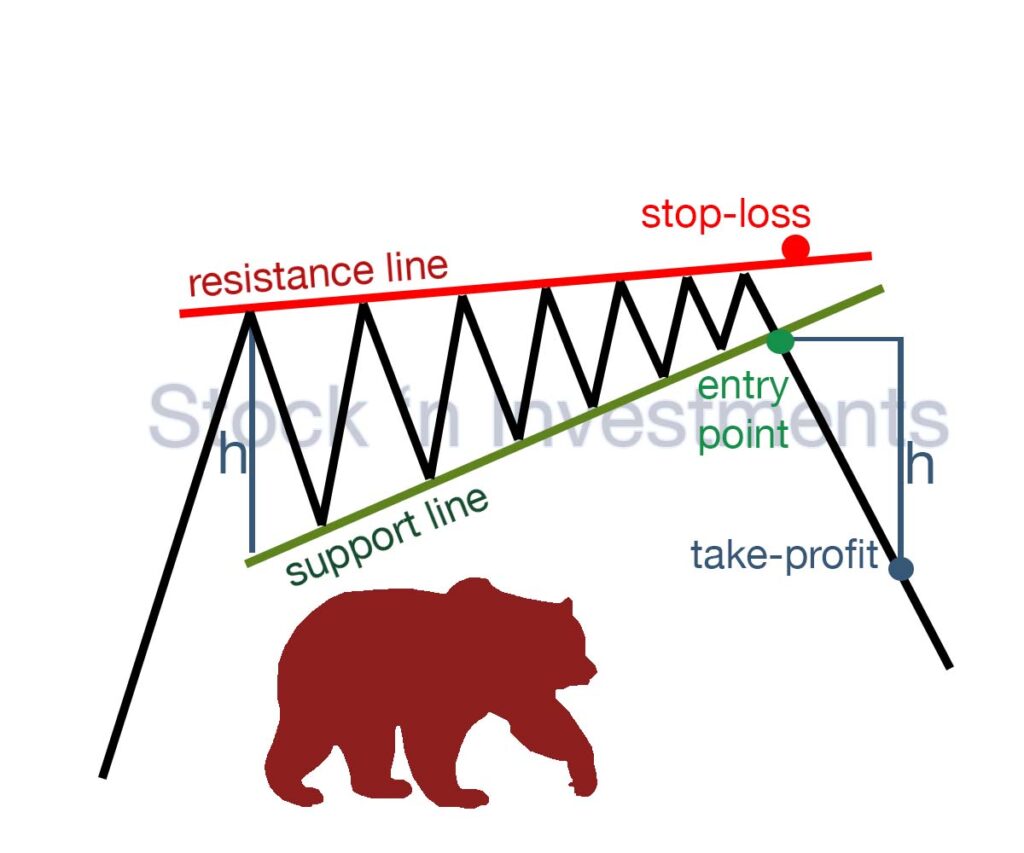

Rising wedge pattern trading

Let’s consider ABC Corp, which is currently trading at $50 and is in an uptrend. Over a few weeks, you notice that the stock is forming higher highs and higher lows, but the highs are rising more slowly than the lows. The price reaches $55, then $57, and finally $58, forming the upper boundary of the wedge. Meanwhile, the price forms the lower boundary by reaching $52, then $54, and finally $56. This forms a wedge shape that is converging.

Entry point

After the rising wedge pattern forms, wait for the price to break below the lower boundary of the wedge. Suppose the price falls below $56. You might decide to enter a short position at $55.50.

Setting the stop-loss

To minimize risk, set the stop-loss above the upper boundary of the wedge. If the last high was at $58, place the stop-loss at $58.50. This will protect you from potential false breakouts.

Take-profit

To determine the profit target, measure the height of the wedge at its widest part. If the height of the wedge is $6 (from $52 to $58), subtract this distance from the breakout point (suppose $56). Therefore, your profit target would be $50 ($56 – $6).

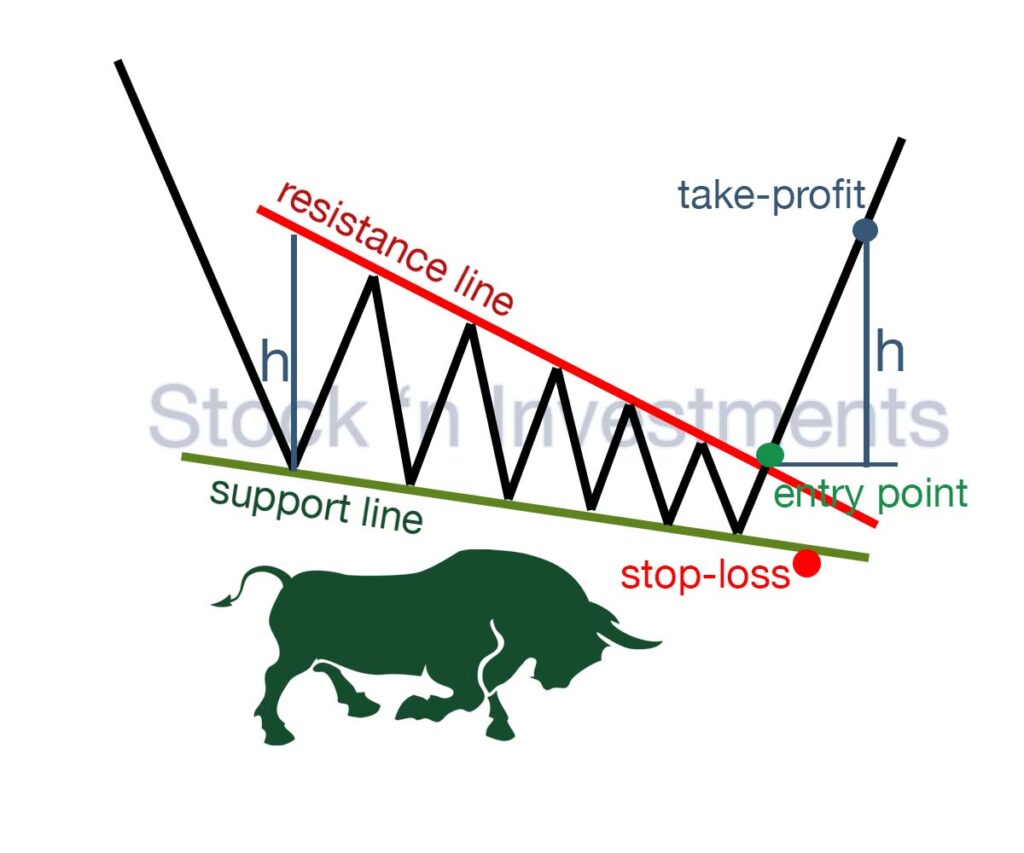

Falling wedge pattern trading

Let’s consider ABC Corp, which is currently trading at $40 and is in a downtrend. Over a few weeks, you notice that the stock is forming lower highs and lower lows, but the lows are falling more slowly than the highs. The price drops to $38, then $36, and finally $35, forming the lower boundary of the wedge. Meanwhile, the price forms the upper boundary by reaching $42, then $41, and finally $40. This forms a wedge shape that is converging downwards.

Entry point

After the Falling Wedge Pattern forms, wait for the price to break above the upper boundary of the wedge. Suppose the price rises above $40. You might decide to enter a long position at $40.50.

Setting the stop-loss

To minimize risk, set the stop-loss below the lower boundary of the wedge. If the last low was at $35, place the stop-loss at $34.50. This will protect you from potential false breakouts.

Take-profit

To determine the profit target, measure the height of the wedge at its widest part. If the height of the wedge is $7 (from $35 to $42), add this distance to the breakout point (suppose $40.50). Therefore, your profit target would be $47.50 ($40.50 + $7).

What does the entry point mean for wedge pattern trading?

An entry point for a wedge pattern refers to the moment when a trader decides to open a position based on the price breakout formed by this pattern. There are two main types of wedges: rising wedge and falling wedge.

For a rising wedge, a trader opens a short position, and for falling — a long position.

What technical indicators should be used for wedge pattern trading?

To trade using the wedge pattern, you should consider using the following technical indicators:

Volume. Monitoring trading volumes can confirm the strength of the breakout. An increase in volume during a breakout from the wedge indicates the strength of the move.

Moving Averages. These help identify the trend and confirm the direction after the breakout. In particular, the 50-day and 200-day moving averages can be useful.

Relative Strength Index (RSI). It can indicate overbought or oversold conditions, which can help spot potential reversals in wedge pattern trading.

Stochastic Oscillator. Helps determine overbought and oversold levels, which can confirm entry or exit signals.

Moving Average Convergence Divergence (MACD). Indicates changes in the strength, direction, momentum, and duration of a trend.

Bollinger Bands: Can help identify levels of volatility and potential reversal points.

How does using a trailing stop affect the success of wedge pattern trading?

Protecting profits. A trailing stop automatically moves with the price as it goes in a favorable direction. This helps protect accumulated profits in case the market suddenly changes direction.

Limiting losses. If the price starts moving against you, a trailing stop can minimize losses by closing the position at a predetermined level.

Automating the process. Using a trailing stop in wedge pattern trading automatically adjusts the stop-loss order, reducing emotional stress and helping avoid impulsive decisions.

Increasing flexibility. A trailing stop allows the trader to stay in the position as long as the price moves favorably, thereby maximizing potential profit.

Adapting to volatility. During periods of high volatility, a trailing stop can help avoid excessive losses and preserve some profit when the market becomes unstable.

Why is it necessary to use a stop-loss in wedge pattern trading?

Risk management. Trading always involves risk, and a stop-loss helps limit potential losses. If the market moves against your position, the stop-loss will close it at a predetermined level, protecting your capital from significant losses.

Preventing emotional decisions. A stop-loss helps avoid emotional decision-making in trading. When the market moves against you, there may be a temptation to hold onto a position in hopes of a turnaround. An automatic stop-loss will close the position, preventing emotions from influencing your decisions.

Preserving capital for future trades. By reducing losses, a stop-loss helps preserve capital for future trading opportunities. This allows you to remain in the market and participate in subsequent trading opportunities, even after a series of unsuccessful trades.

Ensuring discipline. Using a stop-loss encourages traders to adhere to their trading strategy. This fosters discipline, which is a key element of successful trading.

Trade automation. A stop-loss automates the process of closing positions, which is particularly useful when you cannot constantly monitor the market. It ensures that a position will be closed even in your absence or during unexpected market movements in wedge pattern trading.

Protection against market volatility. Markets can be highly volatile, and prices can change rapidly. A stop-loss provides protection against unexpected market fluctuations, allowing the trader to avoid significant losses.

Conclusion

Wedge pattern trading can be highly effective when executed with precision and careful analysis. By understanding the characteristics of rising and falling wedges, employing sound trading strategies, and incorporating technical indicators, traders can significantly enhance their ability to predict and capitalize on market movements. Always remember to manage risk appropriately and stay informed about market conditions to maximize the effectiveness of your wedge pattern trades.