The cup and handle formation is one of stock market patterns. For those who want to succeed in trading, knowledge of technical analysis patterns is essential. If you master the knowledge and can quickly identify patterns on the chart, you can trade successfully not only on stock markets but also on volatile cryptocurrency markets like Binance. You just need to correctly identify the entry and exit points. Let’s break down the cup and handle pattern in detail and clearly.

What does cup and handle formation look like?

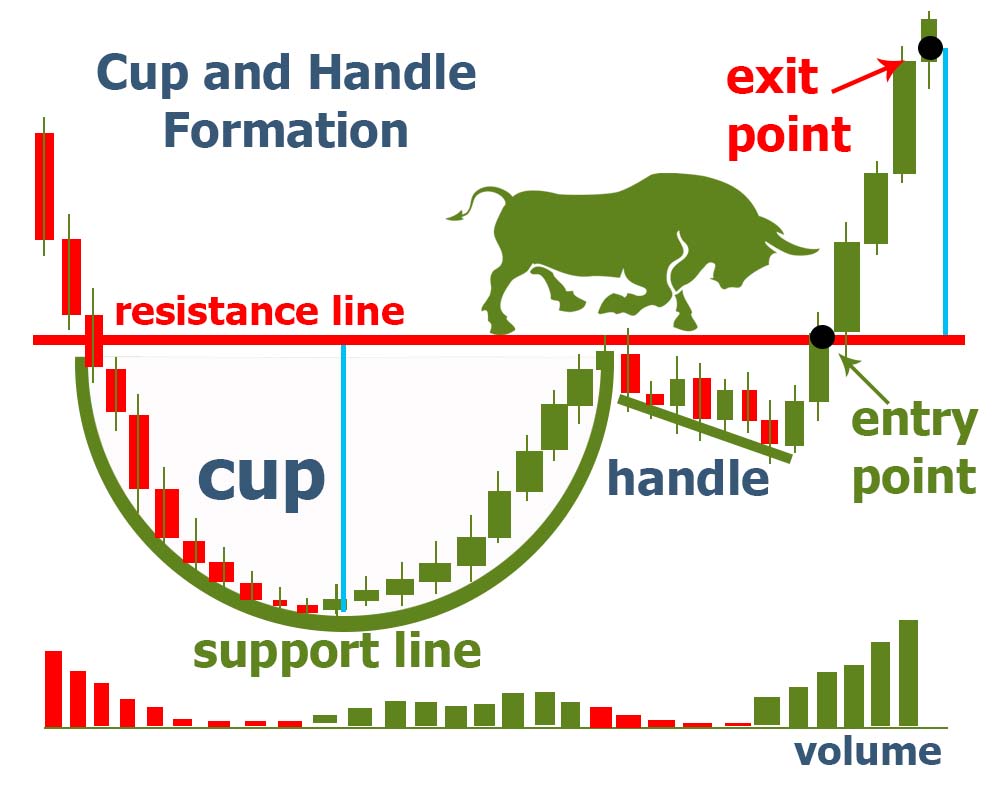

The cup and handle pattern indeed resembles a cup with a handle. First, the cup shape is formed, followed by a slight price decline, typically about 30% from the depth of the cup. Afterward, trading volume begins to increase, along with the price. The entry point for a position is typically at the intersection of the resistance line and the price formation line.

The main elements of formation

To trade successfully, you need to pay attention to the following elements:

- cup

- handle

- resistance line

- support line

- volume

How to trade cup and handle formation?

If you observe the chart on the stock market or Binance, you may notice how the bottom curve is formed, with decreasing trading volumes. It seems like the price starts to rise, but when it reaches the resistance line, the increase turns into a slight decline. Trading volume further decreases. However, with the increase in trading volumes, the price begins to rise again, and the moment it crosses the resistance line is the entry point. It is most predictable that the rise will be approximately the distance from the bottom of the cup to the resistance line. This will be the exit point.

How often does the cup and handle formation occur?

This pattern is not very common. For example, on stock markets, it can take several months to form, while on volatile cryptocurrency markets, it can occur much more frequently.

When entering a position in a cup and handle pattern?

It’s advisable to enter a position when the pattern has fully formed, and the price crosses above the resistance line. Additionally, attention should be paid to trading volume, as it should ideally increase.

When to exit a position in a cup and handle formation?

Exit the position when the price rises to a level equal to the height of the “cup”. Also, pay attention to trading volumes. If they start to decline, it’s advisable to exit the position earlier.

Can the cup and handle formation be used on cryptocurrency markets?

Yes, it can and even should be used. Since cryptocurrency markets are more volatile, this pattern can be encountered much more frequently.

What guarantee is there that the price will rise after the formation of this pattern?

Based on statistics, only 70% of formed patterns are successful. Therefore, manage risks and use stop-loss in cup and handle formation.